Submit 2024 medical expenses for FSA reimbursement by Mar. 31

Employees who participated in and have set aside pre-tax dollars in their Optum Financial Flexible Spending Account have until March 31, 2025 to submit final 2024 expenses.

Expenses paid out of pocket must have been incurred by December 31, 2024 in order to submit for reimbursement. Any expenses incurred after this date would be submitted for 2025.

It is highly recommended to submit your claims now. As we draw closer to the deadline, submissions increase which delays reimbursement.

Claims Submission

If you paid for your expenses out-of-pocket, there are several methods by which you may submit your claims for reimbursement.

- You have until March 31, 2025 to submit claims for 2024 expenses.

- You have until March 31, 2026 to submit claims for 2025 expenses.

Electronic Claims Submission

- Mobile App: Allows you to access your account information wherever you are, 24/7/365. To download, visit the Apple App Store or Android Marketplace and search for Optum Financial Mobile App

- Optum Website: Follow the instructions on the main page to submit your claim for reimbursement.

- How to File a Claim Video

- Sign in to your account. Click on the file claim link on your home page and walk through the steps to enter the details of the claim. Once you have filed your claim and uploaded supporting documentation you must agree to the terms and conditions, then click the Submit button.

Paper Claims Submission

- Complete the FSA Reimbursement Claim Form and submit it with the required documentation to the mailing address or fax number included on the form.

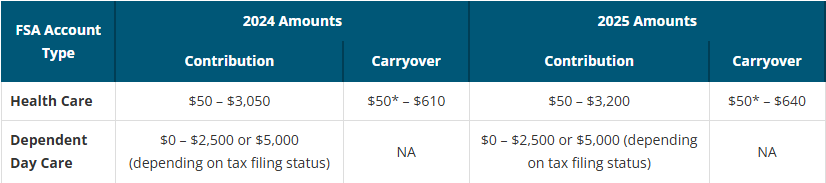

Contributions and Carryover Amounts

- The contribution minimum is established by the Department of Employee Trust Funds (ETF) and approved by the Group Insurance Board (GIB).

- The contribution maximum is established by the IRS on an annual basis, reviewed by ETF and approved by the GIB.

- The carryover provision for the health care FSA allows you to carry over up to a certain amount from one year to the next as long as you remain an active employee on December 31st.

- If eligible, carryover will appear in your health care FSA around April 15th.

Resources

- Optum Financial FSA Handbook

- Page 14 – Acceptable Types of Documentation

- Optum Financial Contact Information

- Website – https://my.optum.com/etf

- Phone: (833) 881-8158

- https://www.wisconsin.edu/ohrwd/benefits/fsaunsubstantiated/

- Unsubstantiated Claims Process