2025 ABE highlight: Life insurance

The Universities of Wisconsin offers life insurance plans that are designed to help protect you and your family against financial hardship in the event of your death. Life insurance can be an inexpensive way to help protect your assets and provide for loved ones.

Resources

- Why life insurance matters – explains why life insurance can be needed at various ages throughout one’s life journey

- Securian Life insurance needs calculator – offers a detailed and quick calculator to estimate needs

- Life Insurance Plan Comparison – compares life insurance plans available including options at end of employment and/or retirement

Changes

- The big change for 2025 is that the University Insurance Association Life Insurance will terminate effective 1/1/25. This was the mandatory life insurance that all eligible Faculty, Academic Staff, and Limited Employees had to enroll in. Employees and continuants enrolled in the Plan as of 1/1/24, will have coverage through 12/31/24.

- UW Employees, Inc. Life Insurance Plan will terminate effective 1/1/25. Employees enrolled in the plan as of 12/31/23 will have coverage through 12/31/24. This was the decreasing term life insurance plan that all employees could elect to take.

- Individual & Family Life has an enhanced enrollment opportunity for 2025.

- If you are currently enrolled, you may increase employee coverage by up to $100,000 (in $5,000 increments, up to plan maximum, without proof of good health), or decrease or cancel coverage. You may also increase your spouse coverage by up to $10,000, and/or child coverage by $2,500 (up to plan maximums).

- If you are not currently enrolled, you may enroll in up to $100,000 employee coverage (in $5,000 increments, without proof of good health).

State Group Life Insurance (SGL)

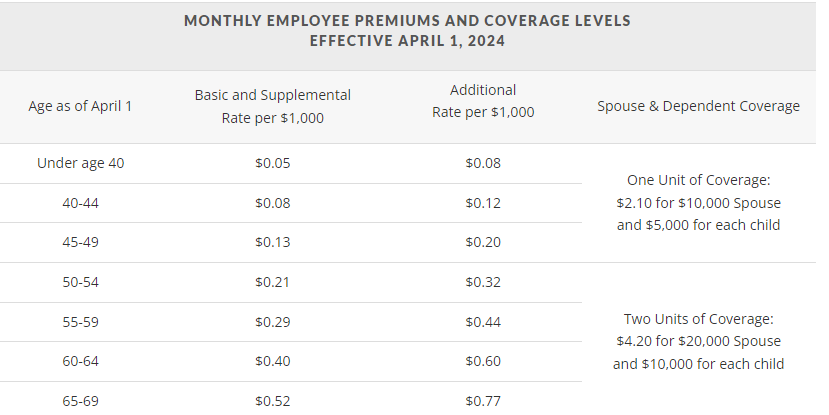

SGL offers term life insurance to you, your spouse, and eligible children. Coverage is based on your eligible earnings. You may elect coverage of up to five times your eligible earnings, up to $20,000 of spouse coverage and up to $10,000 of child coverage. The Universities of Wisconsin System contributes towards the cost of Basic and Supplemental coverage. Employees pay the full cost of Additional coverage.

- Additional Benefits

- Lifestyle Benefit Program through Securian Financial which offers legal, financial and grief resources, travel assistance, legacy planning resources and beneficiary financial counseling to all active, State of Wisconsin employees. This program is offered free of charge and no enrollment is required. For more information review the LifeStyle Benefits Program web page.

- Access to Empathy though Securian Financial. This program provides comprehensive support to assist beneficiaries following the loss of a loved one. The program is offered free of charge to employees enrolled in the SGL program.

- Continuation of group policy coverage at retirement is available (eligibility requirements must be met).

- If your death is accidental, the death benefit will double.

- If you have a dismemberment or experience a loss of use, you may receive a portion of your benefit.

- If you become terminally ill with a life expectancy of 12 months or less, you may receive up to the full amount of your coverage prior to your death.

- Employee Coverage

- Basic Coverage: Provides one unit of coverage equal to your highest calendar year’s earnings, rounded to the next higher $1,000.

- Supplemental Coverage: Provides one unit of coverage equal to your highest calendar year’s earnings, rounded to the next higher $1,000. You must have Basic coverage to enroll in Supplemental coverage.

- Additional Coverage: Provides up to three units of coverage equal to your highest calendar year’s earnings, rounded to the next higher $1,000. You may choose one, two, or three units of Additional coverage. You must have Basic coverage to enroll in Additional coverage (enrollment in Supplemental coverage is not required to enroll in Additional coverage).

- Spouse and Dependent Coverage

- You may elect one or two units of spouse & dependent coverage. Each unit insures your spouse for $10,000 and each dependent child for $5,000. All children will be covered under dependent coverage. Employee’s must enroll in Employee coverage in order to enroll in Spouse & Dependent coverage.

- Resources

- State Group Life Insurance Certificate of Coverage – provides a description of your group term life insurance protection and is your certificate of participation

- State Group Life Insurance Living Benefits – Living Benefits are the proceeds of your life insurance under Wisconsin Public Employers (WPE) Group Life Insurance program, which are paid to you while are you still living rather than to your beneficiaries after your death.

- Empathy Flyer – This program provides comprehensive support to assist beneficiaries following the loss of a loved one.

- Premiums

- SGL premiums are based on your age as of April 1st each year, your highest calendar year of eligible earnings, and your elected coverage levels.

- The employer contribution for Basic coverage is 65.25% of the employee-paid premium. The employer contribution for Supplemental coverage is 37.25% of the employee-paid premiums.

- To calculate your premium, divide your coverage amount (your highest prior calendar year’s actual earnings rounded up to the nearest thousand) by $1,000 and multiply the result by the rate per $1,000 for the coverage level(s) for your age bracket.

Individual & Family Life Insurance

Individual & Family Life Insurance (I&F) offers term life insurance to you, your spouse or domestic partner, and eligible children. You may initially select up to $20,000 of employee coverage, $10,000 of spouse or domestic partner coverage, and $5,000 of child(ren) coverage. There is an annual opportunity to increase coverage during the Annual Benefits Enrollment (ABE).

- Additional Benefits

- Lifestyle Benefit Program through Securian Financial which offers legal, financial and grief resources, travel assistance, legacy planning resources and beneficiary financial counseling to all active, State of Wisconsin employees. This program is offered free of charge and no enrollment is required. For more information review the LifeStyle Benefits Program web page.

- Access to Empathy though Securian Financial. This program provides comprehensive support to assist beneficiaries following the loss of a loved one. The program is offered free of charge to employees enrolled in the SGL program.

- If your death is accidental, the death benefit will double.

- If you become terminally ill with a life expectancy of 12 months or less, you may receive up to the full amount of your coverage prior to your death. This living benefit is also available for an insured spouse/domestic partner or child.

- Employee, Spouse/Domestic Partner, and Child(ren) Coverage

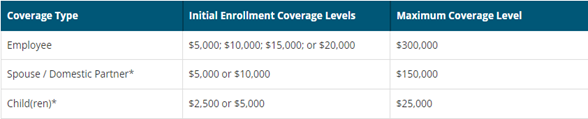

- There are four different initial levels of Employee coverage and two initial levels of Spouse/Domestic Partner and Child(ren) coverage.

- Employees must enroll in Employee coverage in order to enroll in Spouse/Domestic Partner and/or Child coverage.

- The amount of Spouse/Domestic Partner and Child(ren) coverage may not exceed the amount of Employee coverage in effect.

- Resources

- Individual and Family Plan Fact Sheet – provides an overview

- Individual and Family Certificate of Coverage – provides a description of your group term life insurance protection and is your certificate of participation

- Empathy Flyer – This program provides comprehensive support to assist beneficiaries following the loss of a loved one.

- Individual & Family Life Insurance Premium Calculator – allows you to add your information to determine your premium

- Premiums

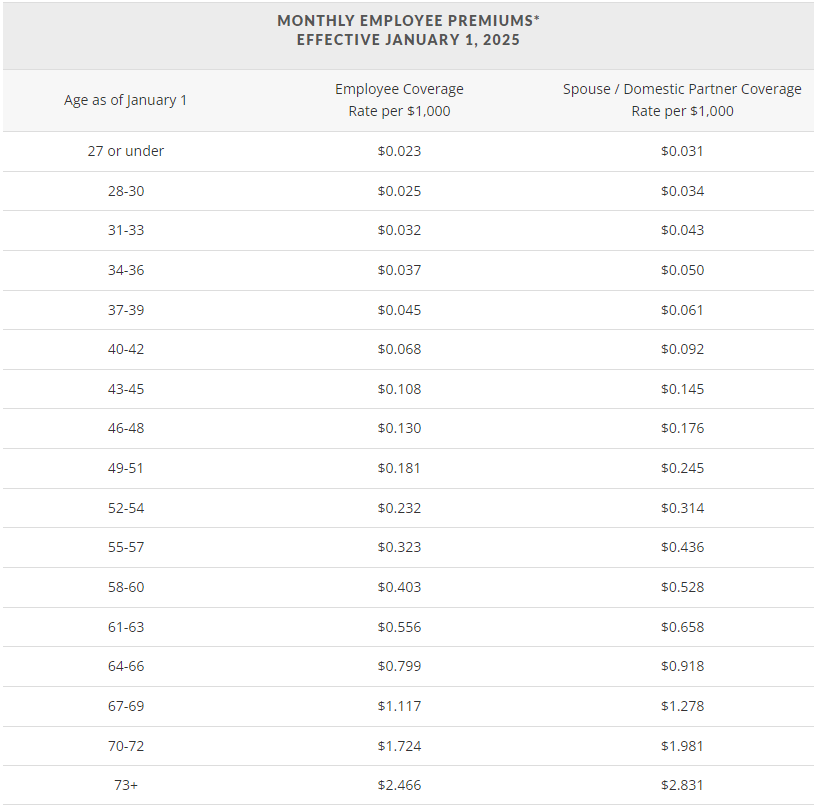

- Individual & Family Life Insurance employee and spouse/domestic partner coverage premium is based on your age as of January 1st each year and your elected coverage level(s).

- Individual & Family Life Insurance initial enrollment coverage levels are $20,000 employee, $10,000 spouse/domestic partner, and $5,000 child.

- The maximum coverage levels allowed are $300,000 employee, $150,000 spouse/domestic partner, and $25,000 child.

- Child coverage premium is $.70 per $1,000 of coverage.

- Individual & Family Life has an enhanced enrollment opportunity for 2025.

- If you are currently enrolled, you may increase employee coverage by up to $100,000 (in $5,000 increments, up to plan maximum, without proof of good health), or decrease or cancel coverage. You may also increase your spouse coverage by up to $10,000, and/or child coverage by $2,500 (up to plan maximums).

- If you are not currently enrolled, you may enroll in up to $100,000 employee coverage (in $5,000 increments, without proof of good health).

If you have any questions or would like to set up an individual Webex or Microsoft Teams meeting, please reach out to CALS HR by emailing hr@cals.wisc.edu.