Get the scoop on changes to the 2025 Annual Benefit Enrollment (ABE)

Below is a summary of the changes for this year’s Annual Benefits Enrollment (ABE) period, which runs Sept. 30 – Oct. 25. This enrollment period is for benefits effective January 1, 2025.

It is highly recommend that the ABE enrollment process be submitted no later than Thursday, Oct. 24 at 4:00 p.m., to avoid any last-minute technology issues or, if needed, to submit paper applications.

Once you enroll, you will receive a confirmation statement viewable through MyUW within 24-48 hours. Review the statement to verify that your ABE elections are correct. It is highly encourage that all employees log into their e-benefits portal and review their elections during open enrollment, even if they are not required to make any changes for 2025.

Employees will be able to view current benefits, enroll in benefits and make changes via the eBenefits Self Service widget in the MyUW portal. Here is the ABE enrollment tipsheet with step-by-step instructions, as well as a quick four-minute ABE 2025 Overview video.

For more details of what benefit changes can be made during ABE, please see the 2025 ABE webpage.

2025 Changes Overview:

State Group Health Insurance

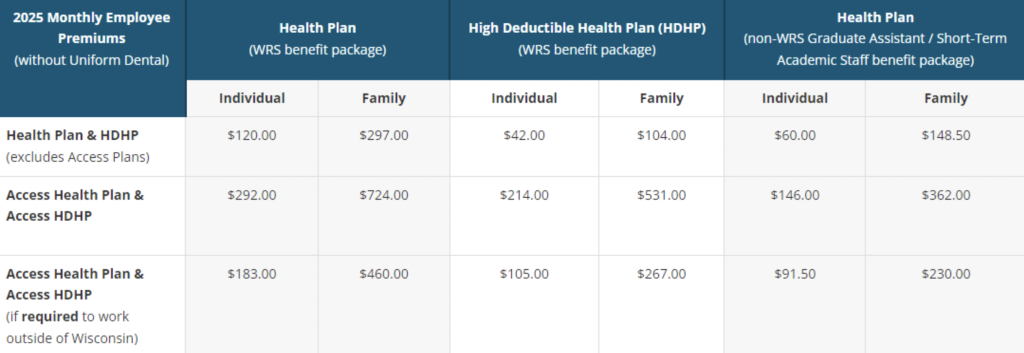

- State Group Health Insurance premiums will increase for 2024. Here are the new 2025 rates.

- High Deductible Health Plan (HDHP) – Annual deductibles increase

- $1,650 for individual

- $3,300 for family coverage

- Health Insurance Plan – Carrier Change

- Dean Health Plan Prevea360 West & Mayo Clinic will be renamed Dean Health Plan Medica West & Mayo Clinic effective 1/1/25.

- If currently enrolled, you will automatically default to Dean Health Plan Medica West & Mayo Clinic with the same plan design and dependents for 2025 unless you select a different plan and/or carrier during ABE.

- Important: Contact your health insurance carrier to make sure that your preferred doctors, clinics, and hospitals will remain in-network. Carrier contact information can be found in the Health Plan Decision Guide.

- Dean Health Plan Prevea360 West & Mayo Clinic will be renamed Dean Health Plan Medica West & Mayo Clinic effective 1/1/25.

- Covered Services

- Expand the lifetime limit for orthoptic eye training

- Clarify coverage for nutritional counseling services related to weight management

Health Insurance Opt-Out Incentive

- If you do not need health insurance coverage through the Universities of Wisconsin, you may be eligible for the Health Opt-Out Incentive. The Opt-Out Incentive is taxable and the $2,000 is paid evenly over 24 pay periods (two paychecks each month).

- Enrollment is required each year to receive the Opt-Out Incentive. Your Opt-Out Incentive does not carryover from year to year.

- Select Opt-Out Incentive option in the MyUW>ABE portal>Health tile, if you do not need health insurance coverage and meet the eligibility requirements for the Opt-Out Incentive.

- Select Waive option in the MyUW>ABE portal>Health tile, if you do not need health insurance coverage and do not meet the eligibility requirements of the Opt-Out Incentive.

- If unable to use MyUW>ABE portal to enroll, complete a paper Health Application and submit to hr@cals.wisc.edu no later than 12 noon on 10/24/24.

Uniform, Preventive & Supplemental Dental Insurance

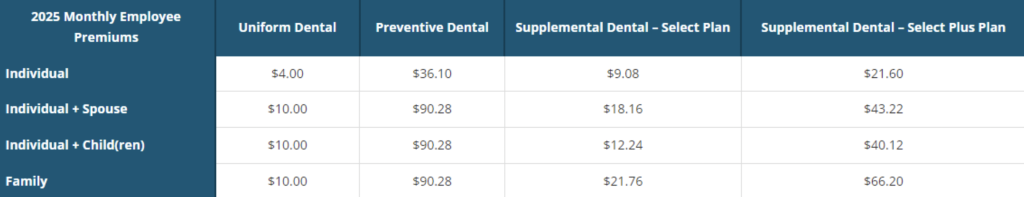

- Employee Premiums

- Uniform Dental (individual coverage) will increase

- Uniform Dental (family coverage) and Supplemental Dental will remain the same

Enhanced Enrollment Opportunity- Individual & Family Life Insurance

- During this enrollment period only, there will be an enhanced enrollment opportunity offered for the Individual & Family (I&F) Life Insurance Plan.

- If you are currently enrolled, you may increase employee coverage by up to $100,000 (in $5,000 increments, up to plan maximum, without proof of good health), or decrease, or cancel coverage. You may increase your spouse coverage by up to $10,000 and/or child coverage by $2,500 (up to plan maximums).

- If you are not currently enrolled, you may enroll in up to $100,000 employee coverage (in $5,000 increments, without proof of good health).

- Employee Premiums

- Premium rates for spouse coverage will decrease.

- Premium rates for employee and child coverage will remain the same.

- Covered Services

- A new Accidental Death & Dismemberment benefit equal to your employee, spouse, and child coverage will automatically be included, at no additional cost.

- The disability premium waiver will no longer be available. If you were approved for disability premium waiver prior to 1/1/25, you are not affected by this change.

Spending and Savings Account Contribution Changes – Health Spending Account (HSA), Flexible Spending Account (FSA), Dependent Day Care Account, Parking & Transit Account

- Enrollment is required each year to receive the appropriate Spending/Savings Account(s). Your HSA, FSA, Dependent Day Care accounts may/may not carryover from year to year so action is needed.

- 2025 Carryover Eligibility

- Have a minimum balance of $50 in your FSA at the end of the run-out period (3/31/25)

- If you are eligible for carryover, it will be applied to your FSA around 4/15/25,

- Re-enroll for the 2025 plan year during ABE

- Have a minimum balance of $50 in your FSA at the end of the run-out period (3/31/25)

- The following will be experiencing maximum contribution changes:

- Health Savings Account (HSA)

- Single: $4,300 ($150 increase)

- Employer contribution will increase to $828 annually ($78 increase)

- Employee can contribute up to $3,472 annually ($150 increase)

- Family: $8,550 ($250 increase)

- Employer will contribute up to $1,650 annually ($150 increase)

- Employee can contribute up to $6,900 annually ($250 increase)

- Additional $1,000 catch-up contribution for employees over age 55

- Single: $4,300 ($150 increase)

- Health Care/Medical AND Limited Purpose Flexible Spending Account (FSA)

- Maximum annual contribution: $3,200 ($150 increase)

- Maximum carryover: $640 ($30 increase)

- Parking & Transit Account

- Maximum monthly contribution: $315 ($15 increase)

- Health Savings Account (HSA)

Other Considerations for 2024

- Wisconsin Retirement System (WRS): Employee and employer contributions to WRS will increase to 6.95% for most employees effective 1/1/25. This is an increase of .05%.

- The following life insurance will no longer be available effective 1/1/25:

- UW Employees, Inc. (UWEI) Life Insurance

- University Insurance Association (UIA) Life Insurance

- State Group Life Insurance: Employee coverage premium will increase 5% for most age groups effective 4/1/25. Spouse & Dependent coverage premium will remain the same.

- Income Continuation Insurance (ICI): Effective 1/1/25, premium rates will decrease.

If you have any questions or would like to set up an individual Webex or Microsoft Teams meeting, please do not hesitate to reach out to CALS HR by emailing hr@cals.wisc.edu.